irs income tax rates 2022

The top tax rate for individuals is 37 percent for taxable income above 539901 for tax year 2022. In the case of a payer using the new 2022 Form W-4P a payee who writes No Withholding on the 2022 Form W-4P in the space below Step 4c.

Irs Releases 2021 Tax Rates Standard Deduction Amounts And More

20 hours agoMarginal rates.

. E-File Your Tax Return Online - Here. There are seven tax rates in 2022. Taxable income between 41775 to 89075 24.

If Taxable Income. 2022 Tax Bracket and Tax Rates. Taxable income between 89075 to 170050 32 Taxable income between 170050 to 215950.

Choosing not to have income tax withheld. Married Individuals Filling Seperately. 10 percent 12 percent 22 percent 24.

This was announced at the back end of 2021 and there is much change compared to last year. 7 rows There are seven federal tax brackets for the 2021 tax year. 26 tax rate applies to income at or below.

585 cents per mile driven for business use up 25 cents. 37 for individual single taxpayers with incomes greater than 539900 647850 for married. In addition beginning in 2018 the tax rates and brackets for the unearned.

The IRS changes these tax brackets from year to year to account for. 10 12 22 24 32 35 and. Beginning on January 1 2022 the standard mileage rates for the use of a car also vans pickups or panel trucks will be.

1 Net Investment Income or 2 MAGI in. Since the 2018 tax year tax brackets have been set at 10 12 22 24 32 35 and 37. 8 rows There are seven federal income tax rates in 2022.

Table 1 contains the short-term mid-term and. For purposes of section 161-21g of the Income Tax Regulations relating to the rule for valuing non-commercial flights on employer-provided aircraft the Standard Industry. Here are the marginal rates for 2022 based on income level.

7 rows 2022 Federal Income Tax Rates. This revenue ruling provides various prescribed rates for federal income tax purposes for January 2022 the current month. For tax year 2022 the top tax rate remains 37 for individual single taxpayers with incomes greater than 539900 647850 for married couples filing.

1 day agoBonuses are considered taxable income by the IRS. 10 12 22 24 32 35 and 37. 38 tax on the lesser of.

103050 206100 28 tax rate applies to income over. For 2022 the IRS announced new tax brackets for those filing their taxes this year. Heres how they apply by filing status.

IRS Tax Tables Deduction Amounts for Tax Year 2022 This article gives you the tax rates and related numbers that you will need to prepare your 2022 federal income tax return. Ad Free IRS E-Filing. Your employer can use two methods aggregate or percentage to calculate withholding.

The 2022 Capital Gains Tax Rate Thresholds Are Out What Rate Will You Pay

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

Income Tax Brackets For 2022 Are Set

Iowans Here S Your 2021 And 2022 Iowa Income Tax Brackets And Planning Opportunities To Know About Arnold Mote Wealth Management

How Much Does A Small Business Pay In Taxes

Tax Brackets Canada 2022 Filing Taxes

Taxtips Ca Manitoba 2021 2022 Personal Income Tax Rates

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

Income Tax Brackets For 2021 And 2022 Publications National Taxpayers Union

2022 Tax Inflation Adjustments Released By Irs

Irs Tax Brackets Calculator 2022 What Is A Single Filer S Tax Bracket Marca

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

Irs Tax Refund Calendar 2022 When To Expect My Tax Refund

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

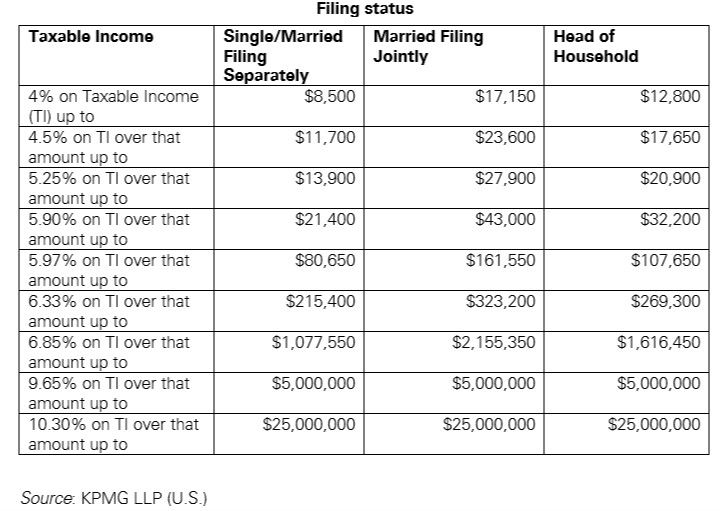

Us New York Implements New Tax Rates Kpmg Global

Who Pays U S Income Tax And How Much Pew Research Center

State Corporate Income Tax Rates And Brackets Tax Foundation